Why Liquidation Preference Can Make or Break Your Startup Dreams

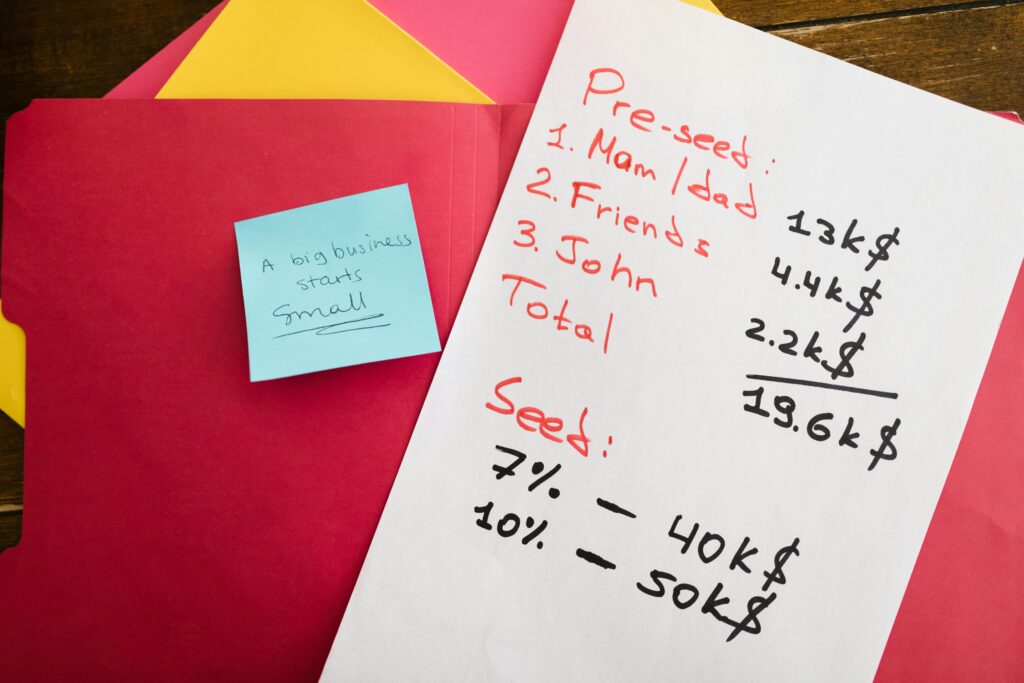

John, the brilliant founder of “InnovateTech,” was on cloud nine. His groundbreaking AI-powered solution was disrupting the market, and investors were lining up to be part of his success story. Eager to fuel his company’s growth, he secured a substantial investment, but there was a hidden clause that would later become his nightmare.

You see, tucked away in the fine print of his investment agreement was a seemingly innocuous term called “liquidation preference.” John, like many first-time founders, didn’t fully grasp its implications. He was focused on the big picture—scaling his business, conquering new markets, and making a difference in the world. Little did he know that this tiny detail could turn his dreams into dust.

What is this Liquidation Preference, Anyway?

When a startup is acquired or goes public, the distribution of proceeds begins with investors getting their money back first, even before the founders. Liquidation preference acts as a VIP pass to the payout line, with investors often demanding a multiple of their original investment.

For example, if an investor puts in $1 million with a 2x liquidation preference, they’ll receive $2 million before any other shareholders get a piece of the pie. Sounds fair, right? Well, it depends.

The Double-Edged Sword

In some cases, liquidation preference can be a win-win. Investors get their money back, and founders still walk away with a handsome reward. But in less-than-ideal scenarios, it can be a disaster for founders.

Consider this scenario: InnovateTech is acquired for $5 million. John’s investors, who put in $3 million with a 2x liquidation preference, get their $6 million back (leaving nothing for John). They made a profit, but John, the one who poured his heart and soul into the company, gets nothing. Ouch!

Have you read?

- How Short-Term Gains Can Become Long-Term Liabilities

- The Hidden Power of Promotion: Why Advertising Works

- Why Smart Entrepreneurs Notarize Contracts

The Moral of the Story

Liquidation preference isn’t inherently evil. It’s a tool investors use to manage risk and protect their investments.However, founders need to be aware of its potential downsides.

Here’s what you should keep in mind when negotiating with investors:

- Know your numbers: Understand the potential impact of liquidation preference on your payout in different exit scenarios.

- Don’t be afraid to negotiate: Try to cap the liquidation preference or make it participating (meaning investors get their money back and share in the remaining proceeds).

- Seek legal counsel: Have an experienced attorney review your investment agreements to ensure you fully understand the terms.

Overall, knowledge is power. Educating yourself about liquidation preference and other investment terms equips you to better protect your interests and build a successful business. Don’t let a hidden clause derail your entrepreneurial journey.

Responses