Your Financial Roadmap: From Vulnerability to Security

Envision setting off on a road trip without checking your fuel gauge. Excitement turns to stress when you realize you might not reach the next gas station. This mirrors our financial lives—without a savings “fuel,” even small bumps can become big hurdles.

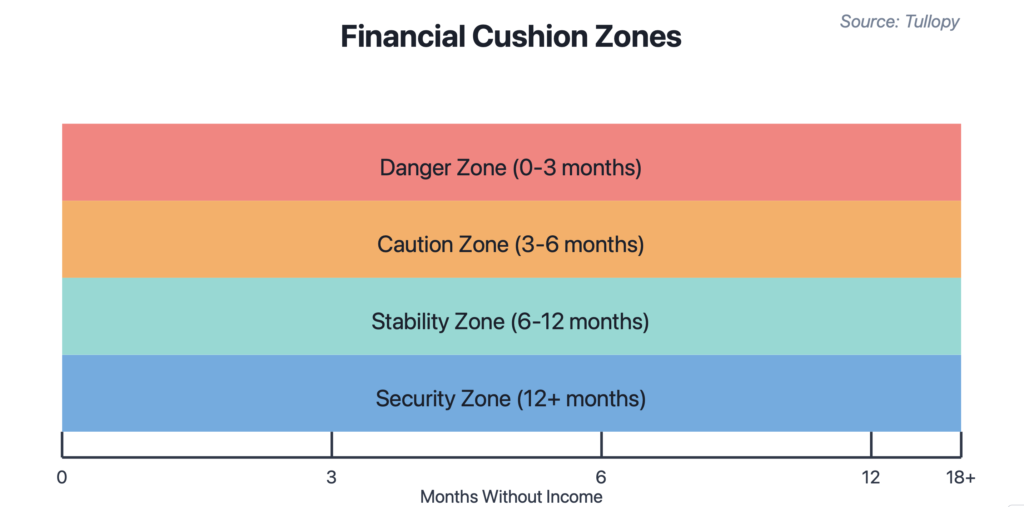

Let’s explore the four Financial Cushion Zones, understand where you stand, and learn how to move toward lasting financial security.

1. Danger Zone (0-3 Months): On the Edge

Story: Alex, a recent graduate, spends most of his paycheck on rent and loans. With less than a month’s expenses saved, a car repair throws his finances into chaos.

Characteristics:

- High Vulnerability: Living paycheck to paycheck.

- Immediate Lifestyle Changes if Income Stops: Risk of missing bills or accruing debt.

- Stress and Anxiety: Worry over unexpected costs.

How to Move Forward:

- Budget Basics:

- Track all expenses to find savings.

- Tool: Apps like Mint or EveryDollar help monitor spending.

- Start an Emergency Fund:

- Aim for at least $500 saved.

- Tip: Automate small transfers to savings each payday.

- Boost Income:

- Take on side jobs like freelancing or gig work.

- Expert Tip: “Multiple income streams can quickly build your safety net.” — Jane Thompson, Financial Advisor

- Learn About Finances:

- Resource: Read “The Total Money Makeover“ by Dave Ramsey.

Considerations:

- Challenges: Limited income or access to financial services.

- Solutions: Seek help from community organizations offering financial advice.

2. Caution Zone (3-6 Months): Building Stability

Story: Priya has saved four months of expenses. When downsized, her savings cushion allows her to job hunt without panic.

Characteristics:

- Basic Emergency Fund: Can handle minor setbacks.

- Buffer for Job Changes: Short-term unemployment is manageable.

- Moderate Adjustments if Needed: May cut back on extras.

How to Strengthen Your Position:

- Refine Your Budget:

- Prioritize needs over wants using the 50/30/20 rule.

- Protect Your Income:

- Get insurance like disability coverage.

- Expert Tip: “Insurance safeguards against income loss.” — Carlos Martinez, Financial Planner

- Set Clear Goals:

- Label savings accounts for specific aims (e.g., “House Fund”).

- Expand Knowledge:

- Attend free financial workshops.

Considerations:

- Obligations: Supporting family can affect savings.

- Solutions: Discuss financial boundaries and share financial education.

3. Stability Zone (6-12 Months): Comfortable and Confident

Story: Maria and John have ten months of expenses saved. John’s career change doesn’t disrupt their lifestyle.

Characteristics:

- Healthy Savings: Can weather bigger financial storms.

- Flexibility for Career Moves: Freedom to pursue better opportunities.

- Maintain Lifestyle During Changes: No drastic cuts needed.

How to Solidify Stability:

- Diversify Investments:

- Open retirement accounts like a 401(k) or IRA.

- Plan Long-Term:

- Save for a home, education, or business.

- Expert Tip: “Long-term goals turn savings into wealth.” — Laura Kim, Investment Strategist

- Review Insurance:

- Ensure coverage matches your current needs.

- Estate Planning:

- Create or update wills.

- Tool: Services like TalkCounsel can help.

Considerations:

- Wealth Gaps: Historical inequalities may impact progress.

- Solutions: Find advisors experienced in overcoming such challenges.

4. Security Zone (12+ Months): Financial Freedom

Story: Sam has two years’ expenses saved and invests wisely. This financial freedom lets Sam start a successful business.

Characteristics:

- Strong Independence: Not reliant on immediate income.

- Buffer for Major Changes: Can handle big life decisions comfortably.

- Freedom to Pursue Opportunities: Take risks without financial strain.

How to Keep Growing:

- Advanced Investing:

- Explore stocks, real estate, or business ventures.

- Expert Tip: “Diversify to maximize returns and minimize risks.” — Michael Lee, Financial Analyst

- Give Back:

- Support causes you care about.

- Tool: Charity Navigator helps find reputable charities.

- Mentor Others:

- Share your knowledge through mentoring.

- Stay Informed:

- Keep up with financial news.

- Read: The Wall Street Journal or Forbes.

Considerations:

- Acknowledging Privilege: Recognize how starting points affect journeys.

- Solutions: Advocate for financial education and equal opportunities.

Chart Your Path Forward

Life is full of surprises. But when you take charge of your finances and make use of the resources available, you’re better equipped to handle whatever comes your way.

Overall, it’s not just about earning more money—it’s about reducing stress and living the life you truly want. Whether you’re just beginning your financial journey or already feel secure, there’s always room to grow and ways to help others along the way.

Responses